Is the Oregon Housing Market Crashing?

As most of us know, the media loves to take information out of context to create sensational headlines. I (Daniel) have been hearing for the past several years that the market is about to crash and that prices are going to plummet.

If you’ve heard the same thing, I’d like to set the record straight. The housing market is not crashing.

That said, we are certainly in a different market than we were 4-5 years ago so I’d like to share 3 quick takeaways:

Interest Rates

By far, the most important factor affecting the housing market right now is that interest rates have remained higher than anyone predicted.

The 30-year mortgage interest rate has mostly hovered between 6-7% for the past three years. Most people thought rates were going to be in 5-6% range by now, so there is a growing sense of frustration in people who were hoping to buy a home this year but still can’t afford it. However, rather than causing a major price drop, the main effect is that homes are staying on the market for longer. This is in contrast 2020-2022 when it wasn’t uncommon to see homes going $50k over asking.

2. The Housing Market is Cyclical

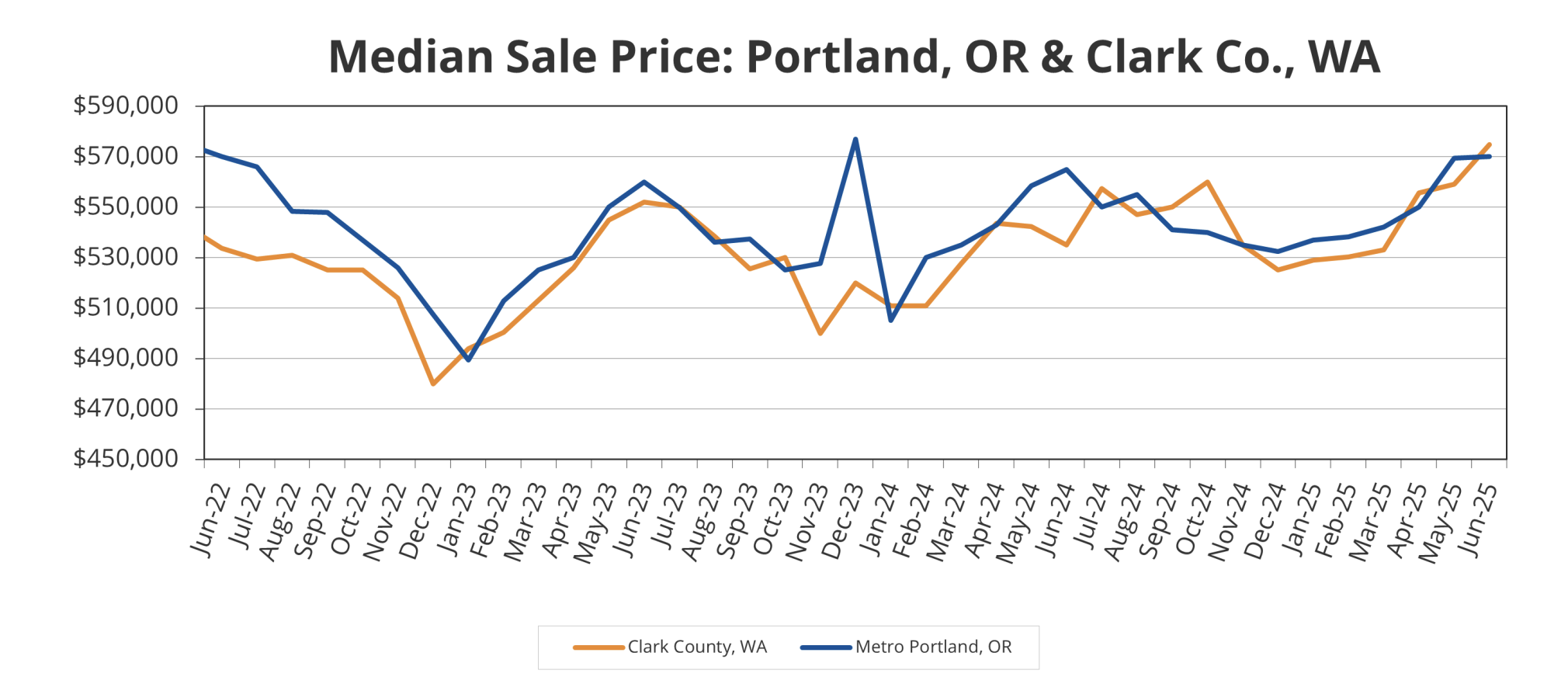

Every year, we see the similar pattern of buyer activity (and prices) picking up in the spring and tapering off in the summer and fall. While it can seem scary to watch prices come back down, it’s a pattern that happens pretty much every year. Price drops are normal at this time of year and it doesn’t mean the market is crashing.

One thing that is different right now is that the price changes throughout the year have been a bit more volatile, with prices staying relatively flat when you adjust seasonally. Historically, appreciation has been in the 5-8% range, so buyers are at least catching a break from rapid price increases.

3. Buyers Have The Upper Hand

According to Redfin, nearly 41% of listings in Oregon had a price drop in June. We have been able to negotiate over $10,000 in seller credits for many of our buyers, which can either put more money in their pockets at closing or pay for a lower interest rate. This can result in buyers ending up with an interest rate under 6%. When interest rates come down below 6% on their own, prices will likely increase fairly rapidly as a flood of buyers enter the market.

Give us a call!

If you’re trying to find the right time to buy or sell for your situation, reach out to us and we’d be happy to have a conversation!

If you’re interested in some more great information about the state of the housing market, check out this article by World Property Journal called Top 10 Things to Know About the U.S. Housing Market Mid-2025